What is DeFi in the Crypto Space sets the stage for a deep dive into the world of decentralized finance, where cutting-edge technology meets traditional finance. Get ready to unravel the mysteries behind this groundbreaking concept.

From popular platforms to potential risks, we’ll cover it all in this comprehensive guide to DeFi in the crypto space.

What is DeFi in the Crypto Space?

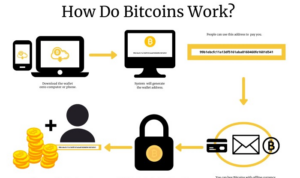

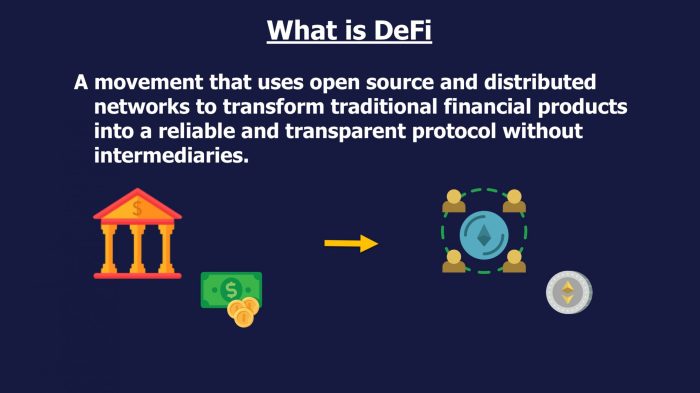

Decentralized Finance (DeFi) refers to a financial system built on blockchain technology that aims to provide open and permissionless access to various financial services without the need for traditional intermediaries like banks or brokerages.

Popular DeFi Platforms and Functionalities

DeFi platforms offer a wide range of services, including:

- Decentralized exchanges (DEX) like Uniswap and SushiSwap that allow users to trade cryptocurrencies directly with each other.

- Decentralized lending platforms such as Compound and Aave that enable users to borrow or lend assets without a central authority.

- Decentralized stablecoins like DAI and USDC that are pegged to fiat currencies and maintain their value through smart contracts.

Differences from Traditional Financial Systems

DeFi differs from traditional financial systems in the following ways:

- Accessibility: DeFi platforms are open to anyone with an internet connection, unlike traditional financial services that may have geographic or regulatory restrictions.

- Transparency: Transactions on DeFi platforms are recorded on the blockchain and can be viewed by anyone, ensuring transparency and reducing the risk of fraud.

- Security: DeFi platforms use smart contracts to automate processes and eliminate the need for intermediaries, reducing the risk of human error or manipulation.

Benefits and Risks of DeFi

While DeFi offers numerous benefits, including financial inclusion, lower fees, and faster transactions, it also comes with potential risks:

- Smart Contract Risks: Vulnerabilities in smart contracts can lead to hacks or exploits, resulting in the loss of funds.

- Regulatory Uncertainty: DeFi operates in a largely unregulated space, which can lead to legal challenges or government intervention.

- Market Volatility: DeFi assets are often highly volatile, and users can experience significant losses if the market takes a downturn.

Decentralized Finance Principles

Decentralized Finance, or DeFi, operates on several key principles that set it apart from traditional financial systems. These principles revolve around decentralization, transparency, security, and the use of smart contracts to enable peer-to-peer lending and borrowing.

Decentralization

Decentralization is a core principle of DeFi, where financial transactions and services are not controlled by any central authority. Instead, DeFi platforms operate on blockchain technology, allowing users to interact directly with each other without the need for intermediaries. This decentralization ensures that users have more control over their funds and financial activities.

Transparency and Security

Transparency is another crucial aspect of DeFi, as all transactions and activities are recorded on a public blockchain, making them easily verifiable by anyone. This transparency helps in building trust among users and ensures the integrity of the system. In addition, security is maintained through the use of cryptographic techniques and secure smart contracts, which help protect user funds from hacks or unauthorized access.

Smart Contracts in DeFi

Smart contracts play a vital role in facilitating DeFi transactions by automating the execution of agreements between parties. These self-executing contracts are stored on the blockchain and are tamper-proof, ensuring that the terms of the agreement are met without the need for intermediaries. Smart contracts enable various DeFi applications such as decentralized exchanges, lending protocols, and prediction markets.

Peer-to-Peer Lending and Borrowing

Peer-to-peer lending and borrowing are key features of DeFi platforms, allowing users to lend their assets to others in exchange for interest or borrow assets by providing collateral. These transactions are executed through smart contracts, which ensure that the terms of the loan and repayment are enforced automatically. Peer-to-peer lending and borrowing provide users with more flexibility and control over their finances, without relying on traditional financial institutions.

DeFi Use Cases: What Is DeFi In The Crypto Space

Decentralized Finance (DeFi) goes beyond just lending and borrowing, offering a wide range of use cases that are revolutionizing the financial industry.

Insurance Services

DeFi is disrupting the insurance sector by providing innovative solutions through smart contracts. Insurers can create decentralized insurance platforms that automatically execute claims when predefined conditions are met, eliminating the need for intermediaries.

- Smart contracts in DeFi can automate the claims process, reducing processing times and costs.

- Decentralized insurance pools allow individuals to pool funds and collectively insure against risks.

- Parametric insurance products use blockchain technology to trigger payouts based on predefined parameters, increasing transparency and efficiency.

Asset Management

DeFi is transforming asset management by enabling users to access a wide range of investment opportunities without relying on traditional financial institutions.

- Decentralized exchanges (DEXs) allow users to trade digital assets directly from their wallets, removing the need for intermediaries.

- Automated trading strategies powered by smart contracts can execute trades based on predefined criteria, reducing human error and bias.

- Liquidity pools in DeFi enable users to earn passive income by providing liquidity for trading pairs.

Impact on Traditional Banking

DeFi is challenging the traditional banking system by offering more inclusive and efficient financial services that are accessible to anyone with an internet connection.

- Users can access DeFi services 24/7 without the need for a bank account or approval from financial institutions.

- Decentralized lending platforms offer lower interest rates and higher returns compared to traditional banks.

- Smart contracts ensure transparent and secure transactions without the need for intermediaries or third parties.

Real-World Applications

Several real-world applications are leveraging DeFi technology to provide innovative solutions to traditional financial problems.

- Aave is a decentralized lending platform that allows users to borrow and lend assets without intermediaries.

- Yearn Finance automates the process of yield farming by optimizing users’ investment strategies across different DeFi protocols.

- Uniswap is a decentralized exchange that enables users to trade tokens directly from their wallets, increasing liquidity and trading efficiency.

Challenges and Future of DeFi

In the rapidly evolving world of decentralized finance (DeFi), there are several challenges that need to be addressed for the ecosystem to reach its full potential. From scalability issues to regulatory uncertainties, the future of DeFi holds both promise and obstacles.

Scalability Concerns in DeFi

One of the major challenges facing DeFi is scalability. As the number of users and transactions on DeFi platforms continues to grow, the current blockchain infrastructure may struggle to keep up with the demand. This results in network congestion, high transaction fees, and slower processing times.

- Implementing Layer 2 solutions: To address scalability issues, DeFi projects are exploring Layer 2 solutions like sidechains and state channels. These solutions aim to offload some of the transaction load from the main blockchain, improving scalability and reducing fees.

- Optimizing smart contract efficiency: Developers are working on optimizing smart contracts to make them more efficient and reduce the computational load on the network. By streamlining code and reducing gas fees, scalability can be enhanced.

Future Trends in DeFi Technology

Looking ahead, the future of DeFi technology is likely to witness several trends that could shape the industry in the coming years.

- Interoperability between DeFi platforms: As the DeFi ecosystem continues to expand, interoperability between different protocols and platforms will become crucial. This will enable seamless asset transfers and liquidity sharing across various DeFi applications.

- Integration of AI and machine learning: DeFi projects are exploring the integration of artificial intelligence and machine learning to enhance risk management, automate trading strategies, and improve user experience. These technologies could revolutionize how DeFi platforms operate.

Regulatory Impact on DeFi Growth, What is DeFi in the Crypto Space

Regulatory frameworks play a significant role in shaping the growth and adoption of DeFi. As the industry matures, regulatory clarity becomes essential for DeFi projects to operate within legal boundaries and gain mainstream acceptance.

- Compliance with AML and KYC regulations: DeFi platforms are increasingly focusing on implementing anti-money laundering (AML) and Know Your Customer (KYC) protocols to comply with regulatory requirements. This helps in mitigating risks associated with illicit activities and enhances trust among users.

- Regulatory scrutiny and enforcement: Regulatory bodies are closely monitoring the DeFi space to ensure compliance with existing financial regulations. How regulators approach DeFi will have a significant impact on the industry’s growth trajectory and overall legitimacy.