The Pros and Cons of Investing in Crypto explores the world of cryptocurrency investments with a fresh and engaging perspective, shedding light on the potential risks and rewards in this digital landscape.

From the basics of crypto investment to the factors to consider before diving in, this discussion covers it all in a way that’s informative and relatable.

The Basics of Crypto Investment

Cryptocurrency is a digital form of currency that operates independently of a central authority, utilizing cryptography for security. Unlike traditional investments like stocks or bonds, cryptocurrencies are decentralized and typically operate on a technology called blockchain.

Blockchain Technology and its Role in Crypto Investments

Blockchain is a distributed ledger technology that records transactions across multiple computers in a secure and transparent manner. In crypto investments, blockchain ensures that transactions are secure, immutable, and transparent, providing a level of trust without the need for intermediaries.

Popular Cryptocurrencies for Investment

- Bitcoin (BTC): The first and most well-known cryptocurrency, often referred to as digital gold.

- Ethereum (ETH): A platform for decentralized applications and smart contracts, with its cryptocurrency called Ether.

- Ripple (XRP): A digital payment protocol that enables fast and low-cost cross-border transactions.

- Litecoin (LTC): Known as the silver to Bitcoin’s gold, offering faster transaction times and lower fees.

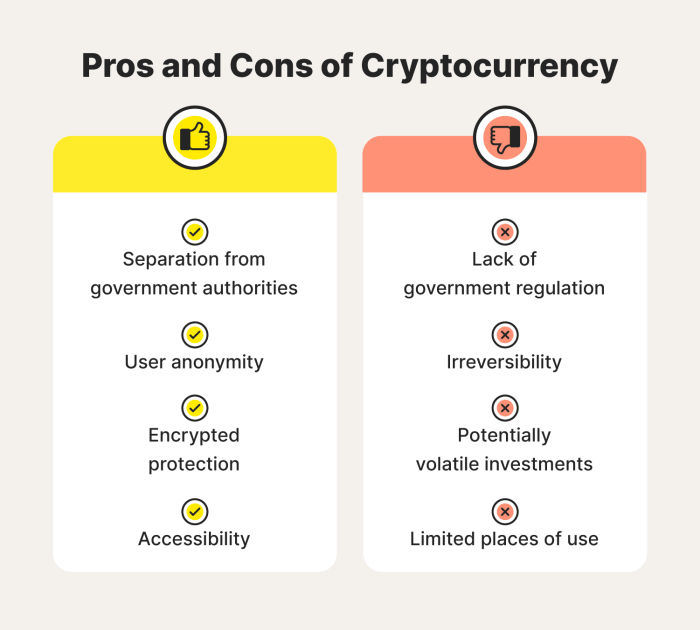

Pros of Investing in Crypto

Investing in cryptocurrencies has the potential for high returns on investment, making it an attractive option for many investors looking to grow their wealth.

Decentralization Benefits Investors

The decentralized nature of cryptocurrencies eliminates the need for intermediaries like banks or financial institutions, giving investors more control over their assets.

Crypto investments are not subject to government interference or manipulation, providing a sense of security and autonomy for investors.

Hedge Against Inflation

- Crypto investments can serve as a hedge against inflation, as the supply of many cryptocurrencies is limited.

- Investors often turn to cryptocurrencies as a way to protect their wealth from the devaluation of fiat currencies.

Cons of Investing in Crypto: The Pros And Cons Of Investing In Crypto

Investing in cryptocurrency comes with its own set of risks and challenges that potential investors should be aware of before diving in. While the crypto market has the potential for high returns, it also carries significant volatility and risks that can impact your investment.

Volatility and Risk

Cryptocurrencies are known for their extreme price volatility, with prices fluctuating wildly within a short period of time. This can lead to significant gains, but also massive losses if the market takes a downturn. The unpredictable nature of the market makes it a risky investment for those who are not prepared to handle the ups and downs.

Regulatory Challenges and Legal Uncertainties

One of the major drawbacks of investing in crypto is the regulatory challenges and legal uncertainties surrounding the industry. Governments around the world are still trying to figure out how to regulate cryptocurrencies, which can lead to sudden changes in laws and regulations that impact the market. This lack of clear regulatory framework can create uncertainty for investors and make it difficult to predict how investments will be affected.

Security and Hacking Threats

Another concern when investing in cryptocurrency is the security of your holdings. Since cryptocurrencies are held in digital wallets, they are vulnerable to hacking and cyber attacks. If your wallet is compromised, you could lose all of your investment in an instant. Ensuring proper security measures and using reputable wallets is crucial to protect your investments from potential threats.

Factors to Consider Before Investing in Crypto

Before diving into the world of cryptocurrency investment, it is crucial to consider a few key factors that can impact your investment decisions significantly. Let’s take a look at some of the important considerations to keep in mind:

Thorough Research

Before investing in any cryptocurrency, it is essential to conduct thorough research. Understanding the technology behind the crypto, the team involved, the project’s goals, and the market demand can help you make more informed investment decisions.

Market Trends and Analysis

To make informed decisions when investing in crypto, it is crucial to understand market trends and analysis. Keeping an eye on price movements, market sentiment, and industry developments can provide valuable insights that can guide your investment strategy.

Risk Management Strategies, The Pros and Cons of Investing in Crypto

When investing in cryptocurrencies, it is important to have risk management strategies in place to mitigate potential losses. Diversifying your investment portfolio, setting stop-loss orders, and only investing what you can afford to lose are some ways to manage risks associated with crypto investments.