Kicking off with How to Navigate the Crypto Market as a Beginner, this guide is here to help you step into the world of cryptocurrency like a pro. From understanding the basics to managing risks, we’ve got you covered with all the essentials you need to know.

Understanding the Basics of the Crypto Market

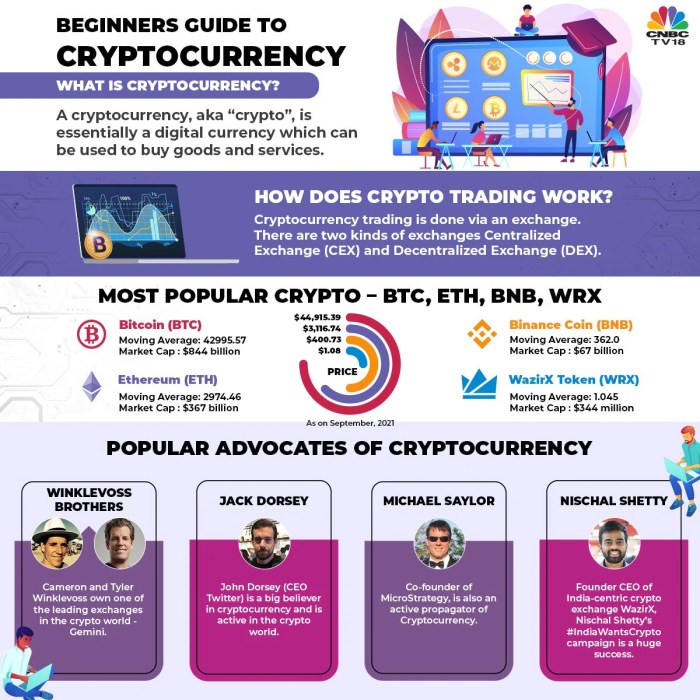

Cryptocurrencies are digital or virtual currencies that use cryptography for security. They operate independently of a central authority, such as a government or financial institution.

Key Terminologies

- Blockchain: A decentralized digital ledger that records transactions across a network of computers.

- Wallets: Digital tools that allow users to store and manage their cryptocurrency holdings securely.

- Exchanges: Platforms where users can buy, sell, and trade cryptocurrencies.

- Tokens: Digital assets created and managed on a blockchain platform.

Significance of Decentralization, How to Navigate the Crypto Market as a Beginner

Decentralization in the crypto market means that there is no single point of control or failure. This ensures that transactions are secure, transparent, and resistant to censorship. Decentralization also promotes financial inclusion and empowers individuals to have more control over their assets.

Getting Started with Buying Cryptocurrency

To begin your journey in buying cryptocurrency, you first need to set up a crypto wallet. This wallet will serve as your digital storage for your crypto assets, allowing you to send, receive, and store different types of cryptocurrencies securely.

Types of Crypto Wallets

When it comes to crypto wallets, there are several types to choose from:

- Hardware Wallets: These are physical devices that store your private keys offline, providing maximum security against hacking.

- Software Wallets: These are applications or software programs that can be downloaded on your computer or mobile device to store your crypto assets.

- Paper Wallets: These are physical documents that contain your public and private keys, printed on paper for offline storage.

- Online Wallets: These are cloud-based wallets that can be accessed through a web browser, providing convenience but may be more susceptible to cyber attacks.

Buying Cryptocurrency from Exchanges

Once you have set up your crypto wallet, you can proceed to buy cryptocurrency from exchanges. Here’s a step-by-step guide to help you through the process:

- Choose a reputable cryptocurrency exchange that supports the cryptocurrencies you want to buy.

- Create an account on the exchange and complete the necessary verification processes.

- Deposit funds into your exchange account using a bank transfer, credit/debit card, or other payment methods supported by the exchange.

- Select the cryptocurrency you want to buy and enter the amount you wish to purchase.

- Review the transaction details and confirm your purchase.

- Once the transaction is complete, transfer the purchased cryptocurrency to your crypto wallet for safekeeping.

Researching and Selecting Cryptocurrencies: How To Navigate The Crypto Market As A Beginner

When it comes to choosing which cryptocurrencies to invest in, it’s crucial to conduct thorough research and due diligence. This will help you make informed decisions and minimize risks in the volatile crypto market.

Factors to Consider when Choosing a Cryptocurrency

- Market Cap: Look at the market capitalization of the cryptocurrency to gauge its size and potential for growth.

- Technology and Use Case: Evaluate the technology behind the cryptocurrency and its practical applications in the real world.

- Team and Partnerships: Research the team members and partnerships associated with the cryptocurrency to assess credibility and potential for success.

- Community and Adoption: Consider the level of community support and adoption of the cryptocurrency to determine its long-term viability.

- Regulatory Environment: Understand the regulatory landscape surrounding the cryptocurrency to anticipate any legal risks.

Importance of Market Research and Due Diligence

- Market research helps you stay informed about the latest trends and developments in the crypto market.

- Due diligence involves verifying the information provided by cryptocurrency projects and ensuring transparency and legitimacy.

- By conducting thorough research and due diligence, you can avoid falling prey to scams and make educated investment decisions.

Analyzing Whitepapers and Project Roadmaps

- Whitepapers provide detailed information about the cryptocurrency project, including its technology, goals, and roadmap.

- Project roadmaps Artikel the milestones and timelines for the development of the cryptocurrency, giving investors insights into the project’s progress.

- When analyzing whitepapers and project roadmaps, pay attention to the team’s credibility, technological innovation, and alignment with your investment goals.

Managing Risks and Security Measures

When it comes to trading cryptocurrencies, it’s essential to be aware of the risks involved and take necessary security measures to protect your investments.

Common Risks Associated with Trading Cryptocurrencies

- Market Volatility: Cryptocurrency prices can be highly volatile, leading to sudden and significant price fluctuations.

- Security Breaches: Exchanges and wallets can be vulnerable to hacking attacks, resulting in the loss of funds.

- Regulatory Changes: Regulations surrounding cryptocurrencies can change rapidly, impacting the market and your investments.

- Scams and Fraud: The crypto market is known for various scams and fraudulent schemes that can deceive investors.

Tips on How to Secure Your Crypto Holdings

- Use Hardware Wallets: Consider storing your cryptocurrencies in hardware wallets offline to protect them from online threats.

- Enable Two-Factor Authentication: Add an extra layer of security to your accounts by using two-factor authentication for login.

- Regularly Update Software: Keep your wallets, exchanges, and devices updated with the latest security patches to prevent vulnerabilities.

The Significance of Private Keys and Two-Factor Authentication

Private keys are cryptographic codes that allow you to access your cryptocurrency holdings. It is crucial to keep your private keys secure and never share them with anyone to prevent unauthorized access to your funds. Two-factor authentication provides an additional security measure by requiring a second verification step, such as a code sent to your phone, to access your accounts. By using both private keys and two-factor authentication, you can enhance the security of your crypto holdings and reduce the risk of unauthorized access.

Following Market Trends and News

Stay up to date with the latest crypto news and market trends to make informed investment decisions. The crypto market is highly volatile, and being aware of current events can help you navigate it more effectively.

Sources for Staying Updated on Crypto News

- Coindesk: A leading cryptocurrency news outlet providing up-to-date information on market trends, regulations, and developments.

- CoinTelegraph: Another reputable source for crypto news, offering insights from industry experts and analysts.

- Twitter: Follow influential figures in the crypto space for real-time updates and opinions on market movements.

Influence of Market Trends on Investment Decisions

- Market trends can impact the value of cryptocurrencies, affecting your portfolio’s performance.

- Positive trends may signal a good time to buy or hold onto your investments, while negative trends could indicate a need to sell or reassess your strategy.

Impact of Social Media and Forums

- Social media platforms like Reddit and Twitter play a significant role in shaping market sentiment and influencing investment decisions.

- Be cautious of misinformation or hype spread through these channels, as they can lead to impulsive trading and potential losses.

- Engage with the crypto community to gain insights, but always verify information and conduct your own research before acting on advice or tips.