Crypto Regulations Around the World sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. From the strict regulations in some countries to the more lenient approaches in others, the world of cryptocurrency is a complex web of rules and challenges that impact the global market in profound ways.

As we dive deeper into the varied regulatory landscape, we uncover the crucial role regulations play in shaping innovation, addressing concerns like money laundering and fraud, and ultimately influencing the future of the crypto industry.

Overview of Crypto Regulations

Cryptocurrency regulations play a crucial role in shaping the future of digital assets and their adoption worldwide. These regulations are put in place to provide a framework for the safe and secure use of cryptocurrencies, protect investors, prevent fraud, and ensure compliance with anti-money laundering laws.

Importance of Regulations in the Cryptocurrency Space

Regulations help create a level playing field for businesses and investors in the crypto space. They provide clarity on legal obligations, reduce market manipulation, and enhance consumer protection. Moreover, regulations can foster innovation by instilling trust and credibility in the industry.

Key Reasons for Implementing Regulations on Cryptocurrencies

- Preventing financial crimes such as money laundering and terrorist financing.

- Protecting investors from scams and fraud in the unregulated market.

- Ensuring tax compliance and preventing tax evasion through crypto transactions.

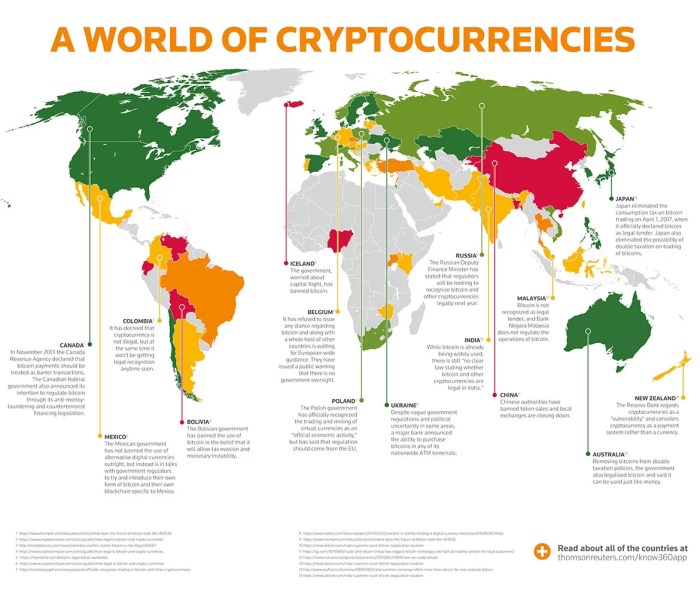

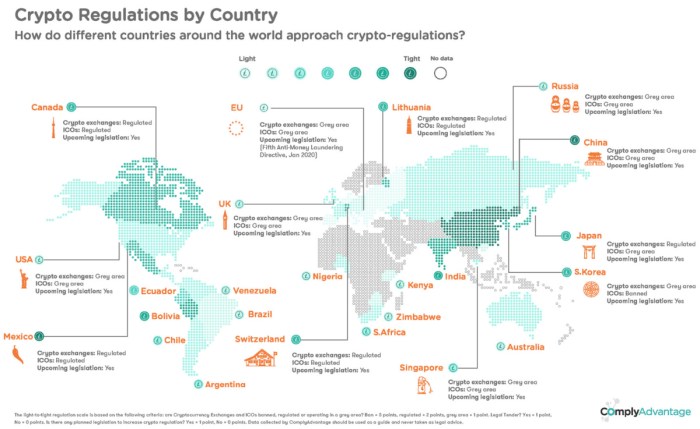

Variation of Regulations Across Countries and Impact on the Global Crypto Market

Cryptocurrency regulations vary significantly from country to country, with some nations embracing digital assets while others impose strict restrictions or bans. This regulatory divergence can create challenges for global crypto adoption, hinder cross-border transactions, and affect market liquidity. Harmonizing regulations across jurisdictions is essential for fostering a healthy and sustainable crypto ecosystem on a global scale.

Major Regulatory Approaches

In the world of crypto regulations, countries take various approaches ranging from strict regulations to more lenient ones. These approaches can have a significant impact on the market and influence how investors and businesses navigate the crypto landscape.

Strict Regulatory Countries

- China: Known for its strict stance on cryptocurrencies, China has banned ICOs and cracked down on crypto mining operations. This has led to a significant decrease in crypto trading activities within the country.

- India: India has also proposed a bill to ban cryptocurrencies, which has created uncertainty and fear among crypto investors and businesses operating in the country.

Lenient Regulatory Countries

- Switzerland: Switzerland has adopted a more lenient approach towards cryptocurrencies by creating a regulatory framework that is supportive of blockchain technology and crypto projects. This has led to the establishment of “Crypto Valley” in Zug, Switzerland, attracting many crypto startups.

- Malta: Known as the “Blockchain Island,” Malta has established itself as a crypto-friendly jurisdiction by implementing clear regulations to provide legal certainty for crypto businesses.

Impact of Regulatory Uncertainty, Crypto Regulations Around the World

Regulatory uncertainty can create challenges for crypto investors and businesses, as they may not know how to comply with changing regulations or whether their investments are secure. This uncertainty can lead to volatility in the market, with prices of cryptocurrencies being heavily influenced by regulatory news and developments.

Regulatory Challenges and Concerns

Cryptocurrency regulations present a unique set of challenges for regulators worldwide. The decentralized nature of digital assets, combined with the global reach of the internet, makes it difficult to implement and enforce consistent regulations. Here, we will explore some common challenges faced by regulators in overseeing the crypto market and discuss concerns related to money laundering, fraud, and other illegal activities within the crypto space.

Challenges Faced by Regulators

- Lack of international coordination: With cryptocurrencies transcending national borders, regulators struggle to coordinate efforts on a global scale.

- Rapidly evolving technology: The fast-paced innovation in the crypto space often outpaces regulatory frameworks, making it challenging for regulators to keep up.

- Anonymity and privacy concerns: The pseudonymous nature of blockchain transactions presents difficulties in tracking illicit activities.

Potential Loopholes in Existing Regulations

- Regulatory arbitrage: Varying regulations across different jurisdictions can lead to regulatory arbitrage, where bad actors exploit regulatory gaps to their advantage.

- Unclear classification of digital assets: The classification of cryptocurrencies as commodities, securities, or currencies can create regulatory ambiguity and loopholes.

- Decentralized exchanges: The rise of decentralized exchanges poses challenges for regulators in monitoring and enforcing compliance.

Concerns Related to Illegal Activities

- Money laundering: Cryptocurrencies can be used for money laundering due to their pseudo-anonymous nature, making it difficult to trace the source of funds.

- Fraud and scams: The lack of consumer protection in the crypto space has led to an increase in fraudulent schemes and scams targeting unsuspecting investors.

- Terrorist financing: There are concerns that cryptocurrencies could be used to finance terrorist activities due to the ease of cross-border transactions and anonymity.

Impact of Regulations on Innovation: Crypto Regulations Around The World

Cryptocurrency regulations play a crucial role in shaping the landscape of innovation within the industry. The way governments and regulatory bodies approach and enforce rules can either foster or hinder the development of new technologies and projects in the crypto sector.

Regulatory Clarity vs. Ambiguity

Regulatory clarity is essential for fostering innovation in the cryptocurrency space. When regulations are clear and well-defined, businesses and developers have a better understanding of the boundaries within which they can operate. This clarity encourages innovation by providing a level of certainty and stability that allows companies to invest in research and development without the fear of regulatory backlash. On the other hand, regulatory ambiguity can have a stifling effect on innovation. When regulations are vague or subject to interpretation, businesses may be hesitant to launch new projects or technologies out of fear of potential legal repercussions. This uncertainty can slow down the pace of innovation in the industry.

Examples of Regulatory Impact

One example of regulatory clarity driving innovation is the development of security token offerings (STOs). STOs are a way for companies to raise funds by issuing digital tokens that represent ownership in an asset, such as real estate or company equity. The clear regulatory framework around STOs in certain jurisdictions has provided companies with the confidence to explore this fundraising method, leading to the creation of new opportunities for investors and businesses alike.

Conversely, regulatory ambiguity in certain countries has hindered the progress of blockchain and cryptocurrency projects. For instance, the lack of clear guidelines around initial coin offerings (ICOs) in some regions has led to many companies avoiding these fundraising mechanisms altogether. This has limited the potential for innovation in the crypto space and forced companies to seek more favorable regulatory environments.

Balancing Oversight and Innovation

Finding the right balance between regulatory oversight and fostering innovation is crucial for the sustainable growth of the cryptocurrency industry. While regulations are necessary to protect investors and maintain market integrity, overly restrictive or unclear regulations can stifle innovation and drive businesses away to more accommodating jurisdictions. Regulatory bodies need to strike a balance that allows for innovation to thrive while ensuring that consumer protection and financial stability are upheld.