Crypto as a Hedge Against Inflation sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

Cryptocurrencies have been making waves in the financial world, especially when it comes to combating inflation. As traditional currencies and assets feel the pressure of inflation, crypto emerges as a modern-day hero, providing a unique solution to safeguard your wealth. Let’s dive into the exciting realm of using crypto as a shield against the eroding effects of inflation.

Overview of Crypto as a Hedge Against Inflation

Cryptocurrencies are increasingly being seen as a hedge against inflation due to their decentralized nature and limited supply. Inflation refers to the decrease in purchasing power of a currency over time, leading to rising prices for goods and services. Traditional currencies, like the US dollar or Euro, are controlled by governments and central banks who can print more money, leading to devaluation and inflation.

Benefits of Using Crypto to Mitigate Inflation

- Crypto, such as Bitcoin, has a capped supply, meaning there is a finite amount that can ever exist. This scarcity helps protect against inflation as more cannot be simply printed.

- Decentralization of cryptocurrencies means they are not controlled by any single entity, reducing the risk of government manipulation that can lead to devaluation.

- With increasing adoption and mainstream acceptance, cryptocurrencies offer a diversified investment option that can potentially outperform traditional assets during times of economic uncertainty and inflation.

Historical Performance

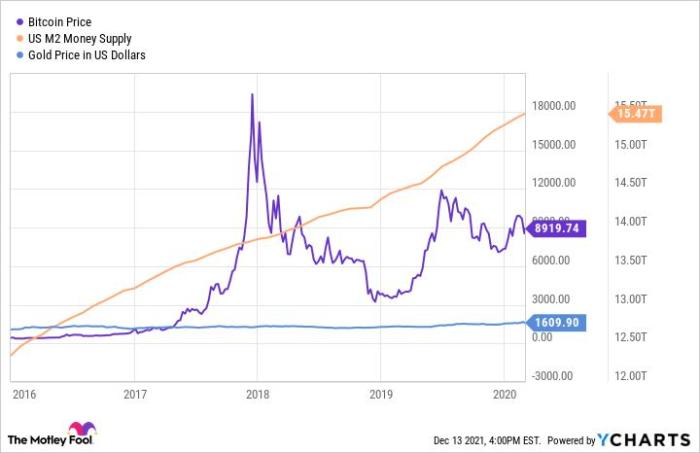

Cryptocurrencies have shown promising resilience as a hedge against inflation, with historical data supporting their performance during periods of high inflation. Some specific cryptocurrencies have stood out for their ability to maintain value and even appreciate in value amidst economic uncertainty. Comparing the performance of crypto assets with traditional hedges like gold or real estate provides valuable insights into the role of cryptocurrencies in hedging against inflation.

Cryptocurrency Performance in High Inflation Periods

Cryptocurrencies like Bitcoin and Ethereum have demonstrated strong performance during times of high inflation. For example, during the hyperinflation crisis in Venezuela, Bitcoin emerged as a popular alternative store of value for citizens looking to protect their wealth. The decentralized nature of cryptocurrencies and their limited supply have made them attractive options for investors seeking protection against inflation.

Specific Cryptocurrencies as Inflation Hedges

In addition to Bitcoin and Ethereum, other cryptocurrencies like Litecoin and Monero have also shown resilience as hedges against inflation. These digital assets offer diversification benefits and can serve as a safeguard against the erosion of purchasing power caused by inflation. Investors looking for alternative investment options during inflationary periods have increasingly turned to cryptocurrencies as a viable solution.

Comparison with Traditional Hedges

When comparing the performance of crypto assets with traditional hedges like gold or real estate, cryptocurrencies have often outperformed in terms of liquidity and ease of access. While gold has historically been considered a safe haven asset during economic turmoil, cryptocurrencies offer a more dynamic and technologically advanced alternative for investors looking to hedge against inflation. Real estate, on the other hand, may lack the liquidity and transparency that cryptocurrencies provide, making digital assets a preferred choice for many investors in today’s digital age.

Factors Influencing Crypto as a Hedge

Cryptocurrencies have emerged as a popular choice for investors looking to hedge against inflation due to several key factors that set them apart from traditional assets.

Decentralization

Decentralization is a fundamental characteristic of cryptocurrencies that makes them attractive as a hedge. Unlike fiat currencies controlled by central authorities, cryptocurrencies operate on a decentralized network of computers, ensuring that no single entity can manipulate the value of the currency.

Limited Supply

Another factor that contributes to crypto’s effectiveness as a hedge is its limited supply. For example, Bitcoin has a fixed supply cap of 21 million coins, which prevents inflationary pressures that can devalue the currency over time.

Global Accessibility

The global accessibility of cryptocurrencies allows investors to diversify their portfolios beyond traditional markets easily. This accessibility enables individuals in countries with high inflation rates to protect their wealth by investing in cryptocurrencies without being restricted by geographic boundaries.

Market Sentiment and Adoption

Market sentiment and adoption play a crucial role in driving crypto’s value during inflationary periods. Positive sentiment from investors and increased adoption by mainstream institutions can lead to a surge in demand for cryptocurrencies, thereby increasing their value as a hedge against inflation.

Risks and Challenges: Crypto As A Hedge Against Inflation

Cryptocurrencies can be a double-edged sword when it comes to using them as a hedge against inflation. While they offer potential benefits, there are also significant risks and challenges to consider.

Risk of Market Volatility

One of the primary risks associated with using cryptocurrencies as a hedge against inflation is the extreme market volatility. The value of cryptocurrencies can fluctuate wildly in a short period, leading to potential losses for investors.

Regulatory Uncertainty, Crypto as a Hedge Against Inflation

Another challenge is the regulatory uncertainty surrounding cryptocurrencies. Governments around the world are still grappling with how to regulate this new form of digital currency, which could impact the effectiveness of using crypto as a hedge against inflation.

Lack of Consumer Protection

Unlike traditional financial assets, cryptocurrencies are not backed by any government or financial institution, leaving investors with limited recourse in case of fraud or theft. This lack of consumer protection poses a significant risk for those using crypto as a hedge.

Cybersecurity Threats

The decentralized nature of cryptocurrencies makes them susceptible to cybersecurity threats and hacking attacks. Investors need to be aware of the risks of storing their digital assets in online wallets or exchanges, as they could be vulnerable to theft.